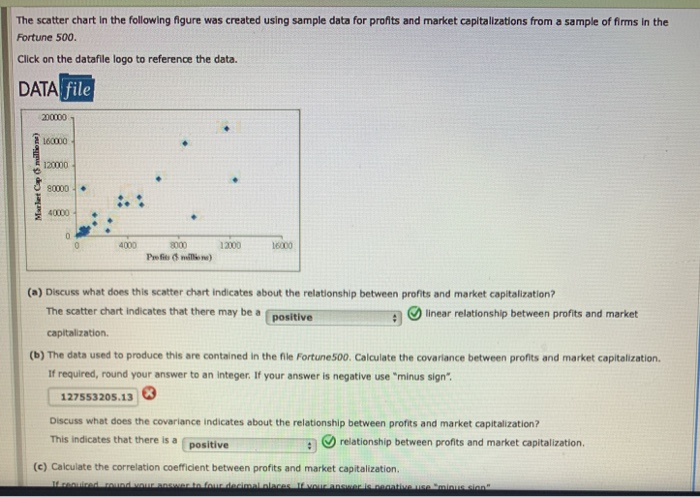

20+ Calculate The Covariance Between Profits And Market Capitalization

Okay lets get to it. WRITE A FORMULA COVAR ARRAY1ARRAY2 AND GET THE COVRIANCE BETWEEN TWO VARIABLES 3.

Solved The Results Of A National Survey Showed That On Chegg Com

Three decimal places b calculate the correlation between profits and market capitalization.

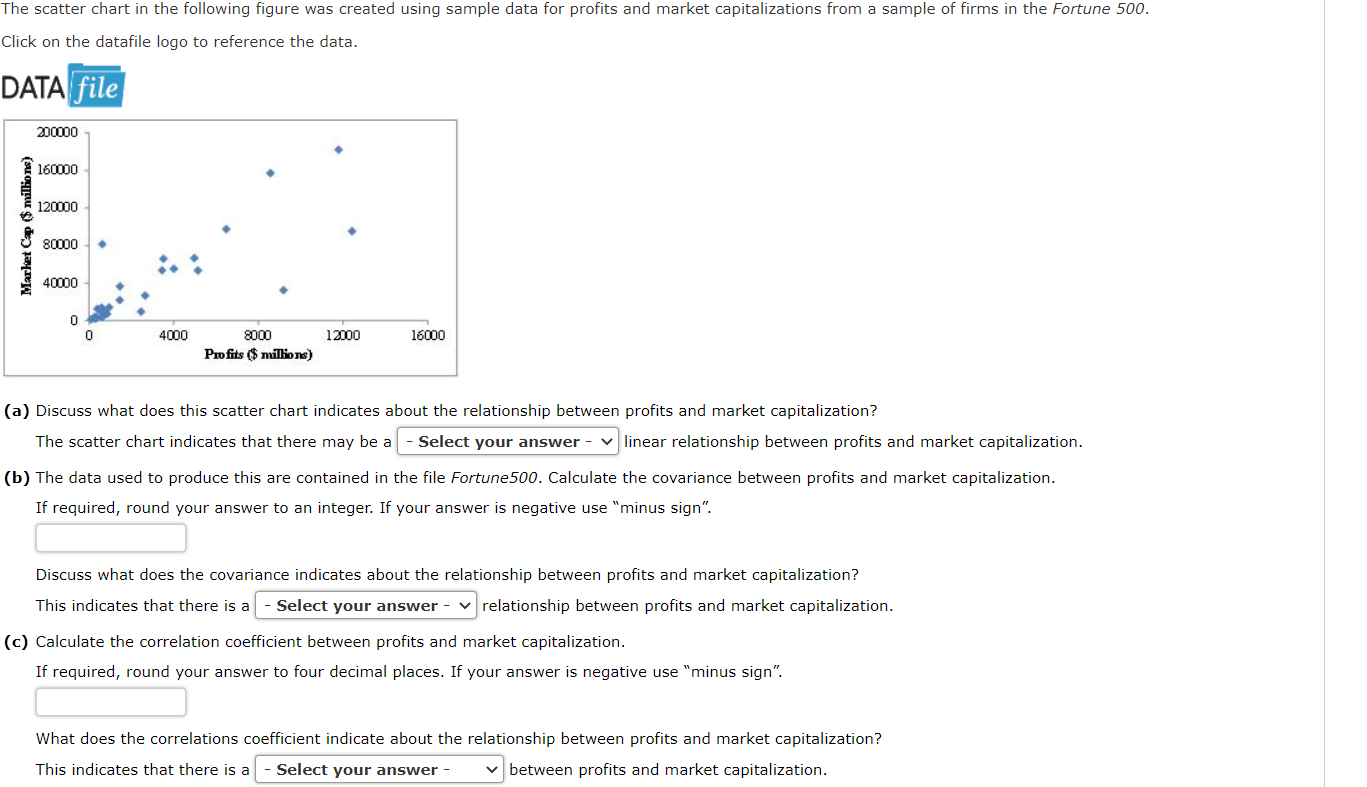

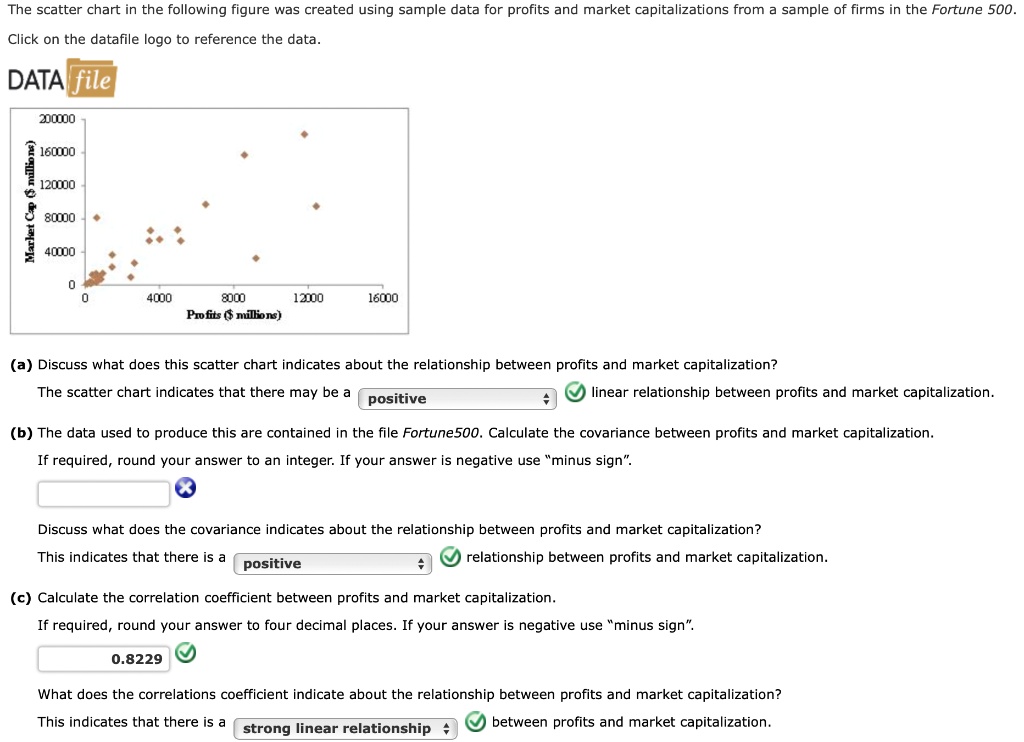

. The relationship between profits and market capitalization indicates that they are strong. The scatter chart indicates that there may be linear relationship between profits and market capitalization positive b the data used to produce this are contained in the file fortunesoo. Calculate the correlation coefficient between profits and market capitalization and what does this indicate about the relationship between profits and market capitalization.

B The data used to produce this are contained in the file. The scatter chart indicates that there may be a _____ linear relationship between profits and market capitalization. BThe data used to produce this are contained in the file Fortune500.

BRING DATA IN TO EXCEL SHEET 2. The scatter chart indicates that there may be a positive linear relationship between profits and market capitalization. 1 Answer to Calculate the covariance between profits and market capitalization and what does the covariance indicate about the relationship between profits and market.

Expert Answer 100 2 ratings COVARIANCE. 1 a calculate the covariance between profits and market capitalization. It says that all the data points are in the Fortune 500 file which I do not have access to but you seem to have everything completed.

Up to 3 cash back Calculate the covariance between profits and market capitalization. Calculate the covariance between profits and market capitalization and what does the covariance indicate about the relationship between profits and market capitalization. A positive covariance means that asset returns move together while a negative.

Covariance is a measure of the degree to which returns on two risky assets move in tandem. Covariance of Profits and Market Capitalization 131804978. Since the covariance is greater than zero the relationship between profits and market capitalization is positive.

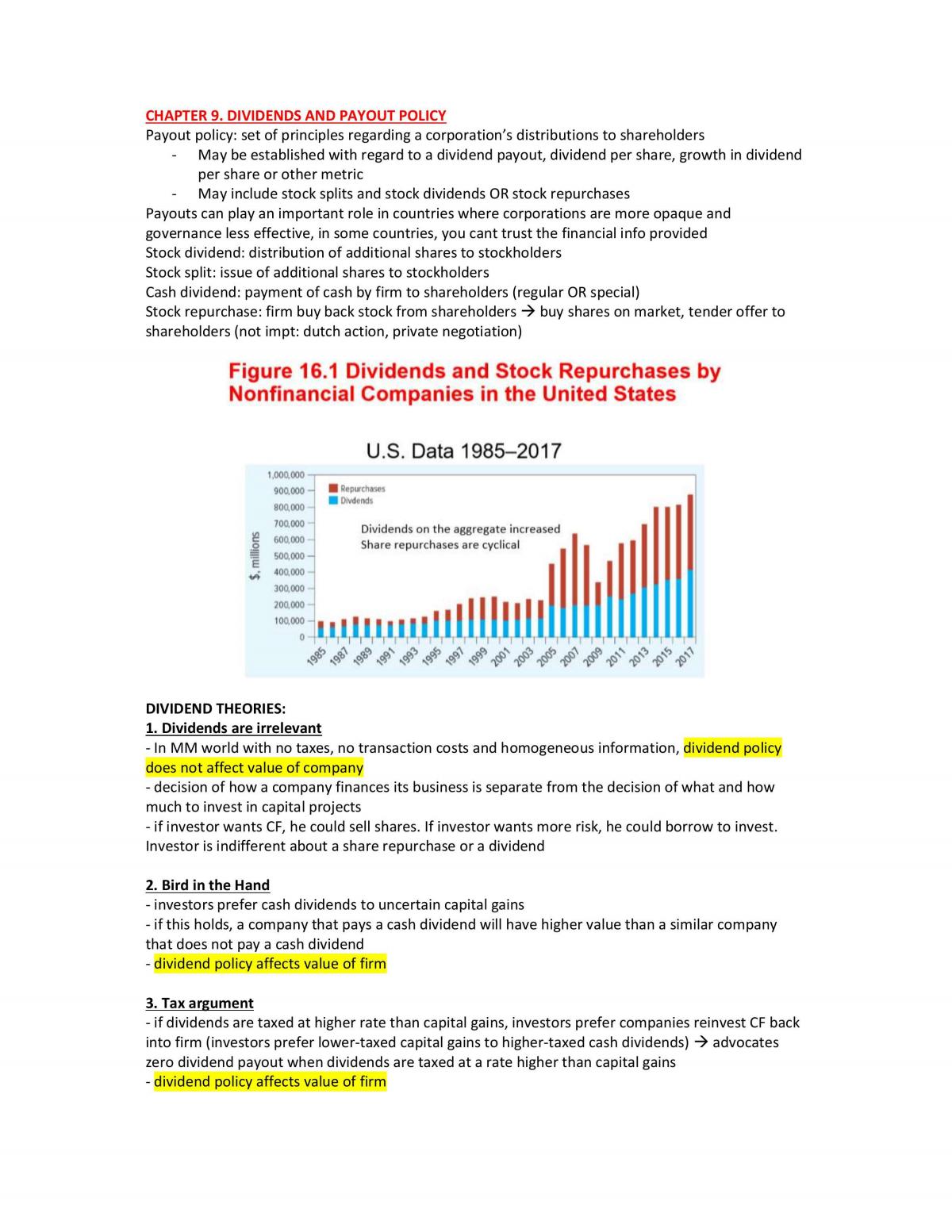

Fin3701 Final Summary Fin3701 Corporate Finance Nus Thinkswap

Betterment Resources Original Content By Financial Experts

Gs 424b2 Htm

The Scatter Chart In The Following Figure Was Created Chegg Com

Pdf Mba H4010 Security Analysis And Portfolio Management Saptarshi Roy Academia Edu

Performance Of Volatility Asset As Hedge For Investor S Portfolio Against Stress Events Covid 19 And The 2008 Financial Crisis Sciencedirect

The Scatter Chart In The Following Figure Was Created Chegg Com

What Return Can Be Expected If Someone Invests Inr 50 000 Month In The Nifty Index For The Next 10 Years Quora

Risk Part 4 Correlation Matrix Portfolio Variance Varsity By Zerodha

Log And Log Return Time Series Of The National Stock Market Indices Download Scientific Diagram

Performance Of Volatility Asset As Hedge For Investor S Portfolio Against Stress Events Covid 19 And The 2008 Financial Crisis Sciencedirect

Performance Of Volatility Asset As Hedge For Investor S Portfolio Against Stress Events Covid 19 And The 2008 Financial Crisis Sciencedirect

Fmqurmqlgxwuum

Betterment Resources Original Content By Financial Experts

Pdf Relationship Between Innovativeness Quality Growth Profitability And Market Value

Covariance Calculator

Solved The Scatter Chart In The Following Figure Was Created Using Sample Data For Profits And Market Capitalizations From Sample Of Firms In The Fortune 500 Click On The Datafile Logo To